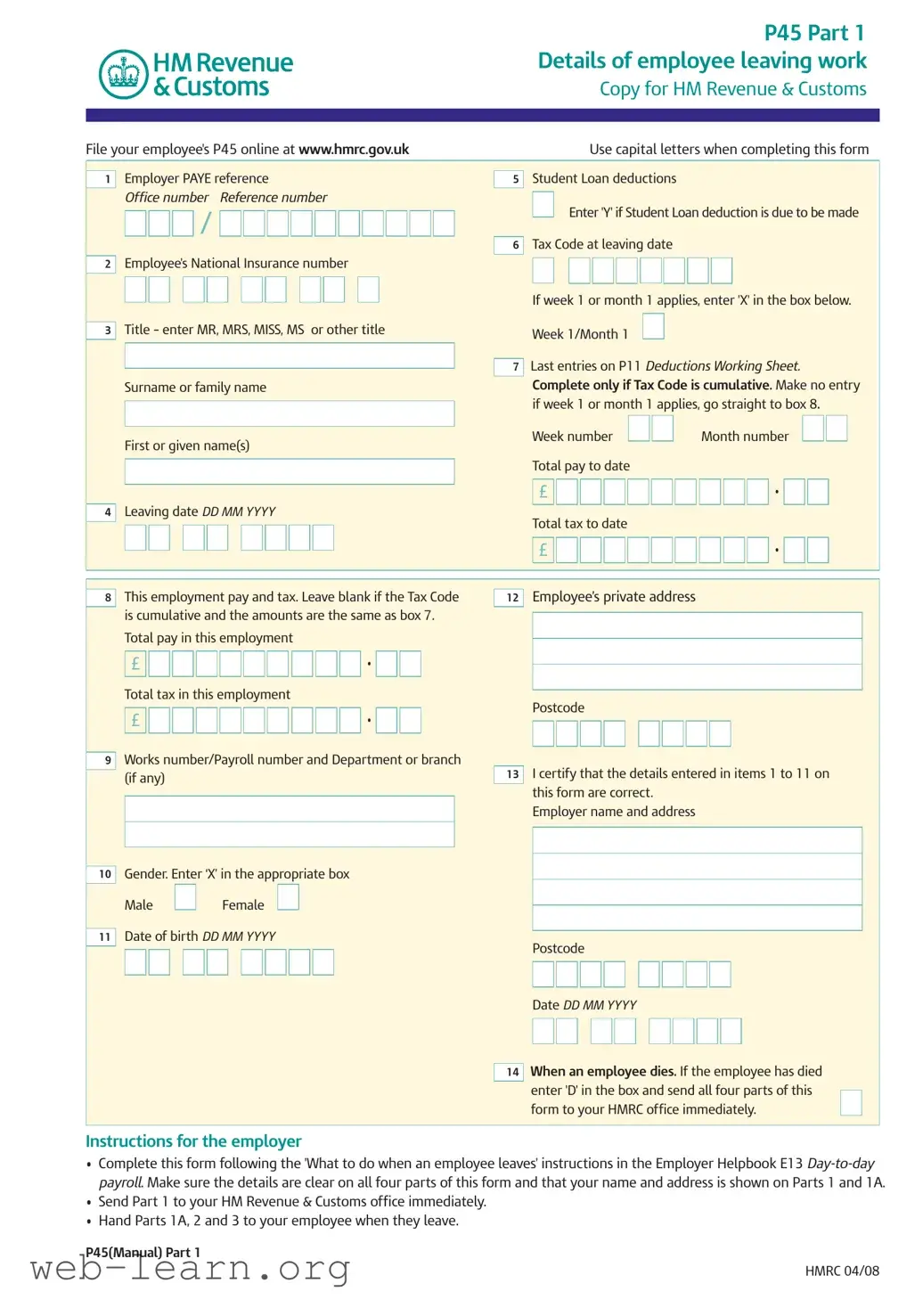

The P45 form is an important document that assists both employers and employees during a transition of employment. When an employee leaves a job, the employer must complete this form to summarize key financial information related to the individual's work and tax contributions. The P45 is divided into several parts: Part 1 is sent to HM Revenue & Customs (HMRC), while Parts 1A, 2, and 3 are retained by the employee and the new employer. This form captures crucial details such as the employee’s National Insurance number, tax code at the time of leaving, total pay to date, and the total tax deducted. If the employee has a student loan, this information must be noted as well. It is essential for new employers to receive Parts 2 and 3 to ensure proper tax deductions based on the tax code of the previous employment. Additionally, the P45 serves as a reference for employees if they need to claim tax refunds or support benefits after leaving a job. Accurate completion and prompt submission of the P45 form can help prevent potential tax complications for both employees and employers.